How to Day Trade: Some General Knowledge

When first learning how to day trade, many go searching online for basic facts and tips on how to get started. In an attempt to make things easier for those seeking further knowledge on the subject, here is some general knowledge on day trading…

Day trading is defined as “…the buying and selling of securities on the same day, often online, on the basis of small, short-term price fluctuations.”

So basically, a typical day trader buys or sells stocks from home during hours in which the markets are open. Many day traders aren’t big fans of waiting, and therefore don’t typically hold trades overnight. Some people like to think of day trading as short term trades in the stock market that usually yield many small profits that pile up over time instead of waiting a lot of time for profits to build.

How to Day Trade: What You Need to Know

The last thing we want you to do is jump into day trading without understanding some of the risks that come along with it. Instead, we’ll get to those right off the bat.

To make money day trading, you must have money to make money.

The first thing you’ll need to realize when it comes to day trading is that those who want to make money doing so will need to already have some money saved when they start. The amount obviously varies depending on expected profits, which market is being traded in, market volatility, etc.

Now it’s time for a shameless plug… there are certain ways in which an individual can day trade without initially having a couple thousand extra dollars just lying around. The option we like more than anything else (for obvious reasons) is our very own Day Trade Smart Trader Pro package. This package allows traders to go through our day trade educational system and have a corporate funded account waiting for them at the finish line!

To learn more about this program, watch the video below!

You can also find this video on our home page, next to an option to schedule a FREE, no-strings-attached webinar to learn more!

Emotion needs to be taken out of it!

Everyone reacts to stress differently. It’s just a fact of life. Unfortunately, many day traders have taken huge losses based on the fact that they let their emotions get the best of them right in the middle of a trade.

The best way to take emotion out of trading is to trade discretionary funds, at least initially, that you can afford to lose if the worst-case-scenario ever actually happens. This way, if a trade starts to go against you (most trades do for a little while), the panic and anxiety that comes will be minimal, and decisions can be made while you’re calm as opposed to flustered.

Don’t have the discretionary funds? See how you can still make money trading by clicking here!

How to Day Trade: SPECIAL OFFER!!

Before we get to the nitty gritty, just a quick reminder that Day Trade Smart has a special offer going on during the month of May!

Through the end of the month, learn how to day trade with Day Trade Smart and get your fees PAID FOR by Green Chart!

How to Day Trade: Can you really make money?

This is the part of the blog where we show you some examples of our own day trading results. Obviously, if this is new to you, it’s going to be hard to understand the image. Luckily, we’re here day or night to help clarify things. Click HERE if you have any questions!

Oh, and really quick, it might be beneficial to read one of our older blogs in order to understand just exactly what the ONIT and SAT trades are! Here is a snippet from a recent blog:

“When we say “ONIT,” we mean the Day Trade Smart Overnight Impact Trade. Similarly, when we say “SAT,” we mean the Day Trade Smart Sunday Afternoon Day Trade. The ONIT is made Monday through Thursday, usually around 3:00 p.m. MST, and the SAT is a similar trade, but only made on Sunday afternoons. The trades are forex trades, and are placed on the EUR USD. Each trader simply sets the trade and forgets the trade each day, and watches the profits roll in.

Day Trade Smart’s traders swear by this trade, and this is the only place you can find it! To learn more about this daily trade, request a personal webinar with us, or register for our free intro webinars on Wednesdays and Thursdays.”

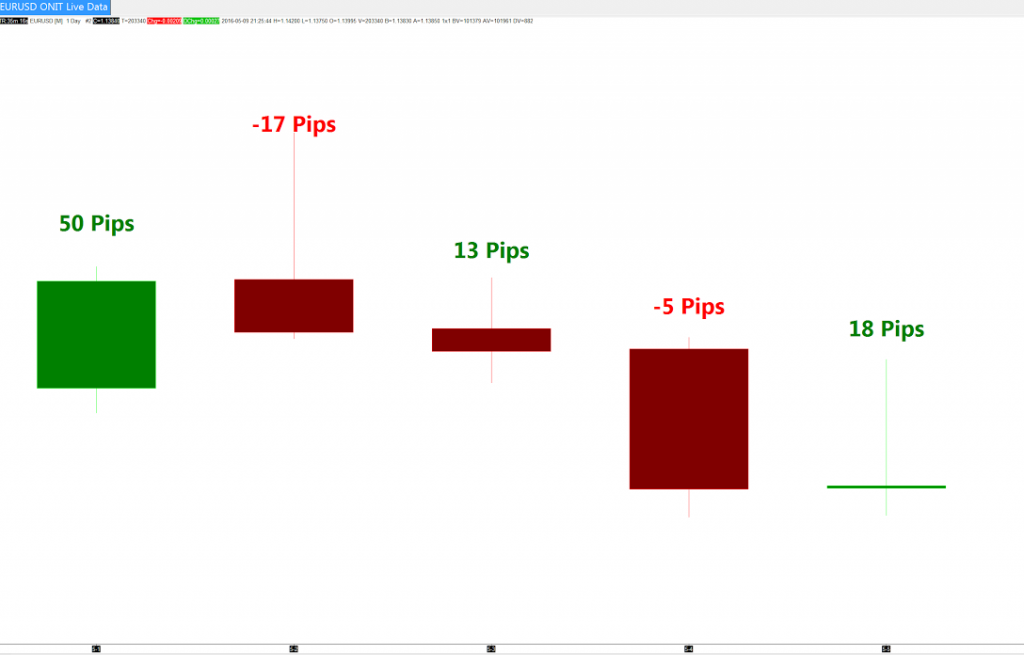

How to day trade: Results from May 1st to May 5th

SAT (Sunday Afternoon) Trade: 50 Pipis

Monday ONIT Trade: -10 Pips

Tuesday ONIT Trade: 10 Pips

Wednesday ONIT Trade: -5 Pips

Thursday ONIT Trade: 18 Pips

Total: 59 pips.

Placing just these Overnight Impact Day Trades or Sunday Afternoon Day Trades last week would have made you:

With an account of $2,500, using a volume of 1, you would have made $590. With an account of $5,000, using a volume of 2, you would have made $1,180. With an account of $10,000, using a volume of 4, you would have made $2,360. With an account of $50,000, using a volume of 20, you would have made $11,800.

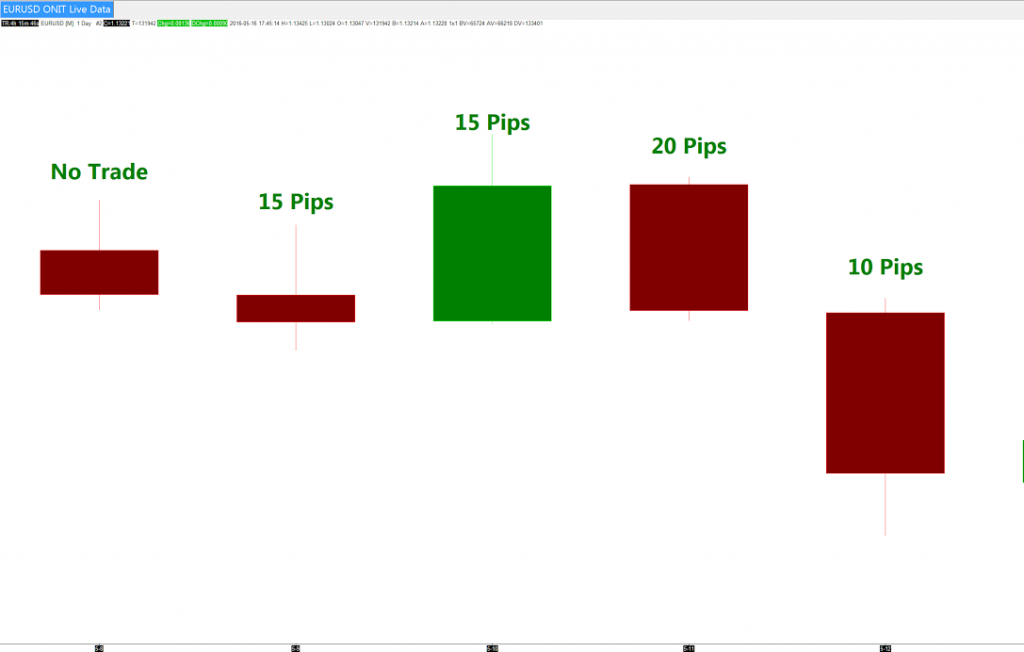

How to day trade: Results from May 8th to May 12th

SAT (Sunday Afternoon) Trade: No Trade

Monday ONIT Trade: 15 Pips

Tuesday ONIT Trade: 15 Pips

Wednesday ONIT Trade: 20 Pips

Thursday ONIT Trade: 10 Pips

Total: 60 pips.

Placing just these Overnight Impact Day Trades or Sunday Afternoon Day Trades last week would have made you:

With an account of $2,500, using a volume of 1, you would have made $600. With an account of $5,000, using a volume of 2, you would have made $1,200. With an account of $10,000, using a volume of 4, you would have made $2,400. With an account of $50,000, using a volume of 20, you would have made $12,000.

How to Day Trade: EUR USD forex OR futures AND other results from May 10, 2016:

Markets may vary…

Trades:6

Contracts: 6

Total Profit: $450

How to Day Trade: Questions or Comments?

For more information on how to day trade, or Day Trade Smart’s day trade education program, contact us, request a FREE no-strings-attached webinar or check out our Facebook, Twitter or Google Plus!